The Mathematics of Finance

Welcome to Our Site

I greet you this day,

These are the solutions to questions on the Mathematics of Finance.

If you find these resources valuable and if any of these resources were helpful in your learning of

Mathematics, please consider making a donation:

Cash App: $ExamsSuccess or

cash.app/ExamsSuccess

PayPal: @ExamsSuccess or

PayPal.me/ExamsSuccess

Google charges me for the hosting of this website and my other

educational websites. It does not host any of the websites for free.

Besides, I spend a lot of time to type the questions and the solutions well.

As you probably know, I provide clear explanations on the solutions.

Your donation is appreciated.

Comments, ideas, areas of improvement, questions, and constructive criticisms are welcome.

Feel free to contact me. Please be positive in your message.

I wish you the best.

Thank you.

Symbols and Meanings

- $Per\:\:annum$ OR $Per\:\:year$ OR $Annually$ OR $Yearly$ means for a year (per $1$ year)

- $SI$ OR $I$ = Simple Interest or Dividend or Yield or Return ($)

- $P$ = Principal or Present Value or Investment ($)

- $r$ = Rate or Annual Interest Rate or Annual Percentage Rate (%)

- $APR$ = Rate or Annual Percentage Rate (%)

- $t$ = Time $(years)$

- $A$ = Amount or Future Value ($)

- $CI$ OR $I$ = Compound Interest or Yield or Dividend or Return($)

- $m$ = Number of Compounding Periods Per Year

- $n$ = Total Number of Compounding Periods $(years)$

- $i$ = Interest Rate Per Period $(\%) \:\:per\:\: period$

- $CCI$ = Continuous Compound Interest or Yield or Dividend or Return($)

- $APY$ = Annual Percentage Yield or Effective Interest Rate or True Interest Rate (%)

- $FV$ = Future Value ($)

- $PMT$ = periodic payment ($)

- $PMTs$ = total periodic payments ($)

- $PV$ = Present Value of all payments ($)

- $a_{n\i}$ = $a$ angle $n$ at $i$

- $s_{n\i}$ = $s$ angle $n$ at $i$

- $PV$ = Present Value of all payments ($)

- $payoff$ = payoff amount for a mortgage

- $k$ = number of remaining payments

- $CFV$ = Combined Future Value ($)

- Rule of $78$

- $UI$ = Unearned Interest or Interest Refund ($)

- $PMT$ = Monthly Payment ($)

- $k$ = Number of remaining monthly payments OR remaining number of monthly payments

- $TI$ = Total Interest ($)

- $n$ = original number of payments

- $TP$ = Total Payments ($)

- $LA$ = Loan Amount or Finance Charge ($)

- $RF$ = Refund Fraction

- $LAR$ = Loan Amount Refund or Finance Charge Refund ($)

- Bonds

- $CP$ = Coupon Payment ($)

- $CR$ = Coupon Rate (%)

- $FV$ = Face Value or Par Value of the Bond ($)

-

$m$ = Number of Coupon Payments per year

This is similar to the number of compounding periods per year. - $BP$ = Bond Price ($)

- $YTM$ = Yield to Maturity ($\%$)

- $t$ = time to reach maturity (years)

- $Annualized\:\:YTM$ = Annualized Yield to Maturity ($\%$)

Mathematics of Finance Formulas

Financial Mathematics Literacy

(1.) Monthly interest payment = Monthly interest rate * Average balance

(2.) Net monthly cash flow = Monthly income − Monthly expenses

Simple Interest

$ (1.)\:\: SI = Prt \\[3ex] (2.)\:\: SI = A - P \\[3ex] (3.)\:\: P = \dfrac{SI}{rt} \\[5ex] (4.)\:\: t = \dfrac{SI}{Pr} \\[5ex] (5.)\:\: r = \dfrac{SI}{Pt} \\[5ex] (6.)\:\: A = P + SI \\[3ex] (7.)\:\: A = P(1 + rt) \\[3ex] (8.)\:\: P = \dfrac{A}{1 + rt} \\[5ex] (9.)\:\: t = \dfrac{A - P}{Pr} \\[5ex] (10.)\:\: r = \dfrac{A - P}{Pt} \\[5ex] (11.)\:\: SI = \dfrac{Art}{1 + rt} $

Compound Interest

$

(1.)\:\: A = P\left(1 + \dfrac{r}{m}\right)^{mt} \\[7ex]

(2.)\:\: P = \dfrac{A}{\left(1 + \dfrac{r}{m}\right)^{mt}} \\[10ex]

(3.)\:\: r = m\left[\left(\dfrac{A}{P}\right)^{\dfrac{1}{mt}} - 1\right] \\[10ex]

(4.)\:\: r = m\left(10^{\dfrac{\log\left(\dfrac{A}{P}\right)}{mt}} - 1\right) \\[10ex]

(5.)\:\: t = \dfrac{\log\left(\dfrac{A}{P}\right)}{m\log\left(1 + \dfrac{r}{m}\right)} \\[7ex]

(6.)\:\: A = P + CI \\[3ex]

(7.)\:\: CI = A - P \\[3ex]

(8.)\:\: A = P(1 + i)^n \\[4ex]

(9.)\:\: P = \dfrac{A}{(1 + i)^n} \\[7ex]

(10.)\:\: i = \dfrac{r}{m} \\[5ex]

(11.)\:\: n = mt \\[3ex]

(12.)\;\; Total\;\;Return = \dfrac{A - P}{P} * 100\% \\[7ex]

(13.)\;\; Annual\;\;Return = \left[\left(\dfrac{A}{P}\right)^{\dfrac{1}{t}} - 1\right] * 100\% \\[7ex]

$

Future Value (Amount) of Cash Flows (Principal) for Several Years

$

(13.)\:\:At\:\:the\:\:end\:\:of\:\:each\:\:year:\:\: FV = PV\left(1 +

\dfrac{r}{m}\right)^{m(last\:\:year - that\:\:year)} \\[7ex]

(14.)\:\: Total\:FV = \Sigma FV

$

Values of $m$

| If Compounded: | m = |

|---|---|

| Annually |

$1$ ($1$ time per year) Also means every twelve months |

| Semiannually |

2 (2 times per year) Also means every six months |

| Quarterly |

4 (4 times per year) Also means every three months |

| Monthly |

12 (12 times per year) Also means every month |

| Weekly | 52 (52 times per year) |

| Daily (Ordinary/Banker's Rule) | 360 (360 times per year) |

| Daily (Exact) | 365 (365 times per year) |

Continuous Compound Interest

$ (1.)\:\: A = Pe^{rt} \\[4ex] (2.)\:\: P = \dfrac{A}{e^{rt}} \\[7ex] (3.)\:\: t = \dfrac{\ln \left(\dfrac{A}{P}\right)}{r} \\[7ex] (4.)\:\: r = \dfrac{\ln \left(\dfrac{A}{P}\right)}{t} \\[7ex] (5.)\;\; Total\;\;Return = \dfrac{A - P}{P} * 100\% \\[7ex] (6.)\;\; Annual\;\;Return = \left[\left(\dfrac{A}{P}\right)^{\dfrac{1}{t}} - 1\right] * 100\% $

APY for Compound Interest

$ (1.)\:\: APY = \left(1 + \dfrac{r}{m}\right)^m - 1 \\[7ex] (2.)\:\: r = m\left[(APY + 1)^{\dfrac{1}{m}} - 1\right] \\[7ex] (3.)\:\: r = m\left(\sqrt[m]{APY + 1} - 1\right) $

APY for Continuous Compound Interest

$ (1.)\:\: APY = e^r - 1 \\[4ex] (2.)\:\: r = \ln(APY + 1) $

Investments

(1.) Market Capitalization (Market Cap) = Total Number of Outstanding Shares * Current Share Price

Income Taxes

(1.) Gross income (GI) = sum of all Income a person receives during the year, including wages, tips,

profits from a business, interest or dividends from investments.

(2.) Adjusted Gross Income (AGI) = Gross Income − Contributions for individual retirement accounts

or any other tax-deferred savings plans

(3.) Taxable Income (TI) = Adjusted Gross Income − Exemptions and Deductions

Between Standard deduction and Itemized deductions, use whichever is higher.

(4.) If Standard Deduction > Itemized Deductions:

Use Standard Deduction

Savings in Taxable Income = Standard Deduction − Itemized Deductions

(5.) If Itemized Deductions > Standard Deductions:

Use Itemized Deductions

Savings in Taxable Income = Itemized Deductions − Standard Deduction

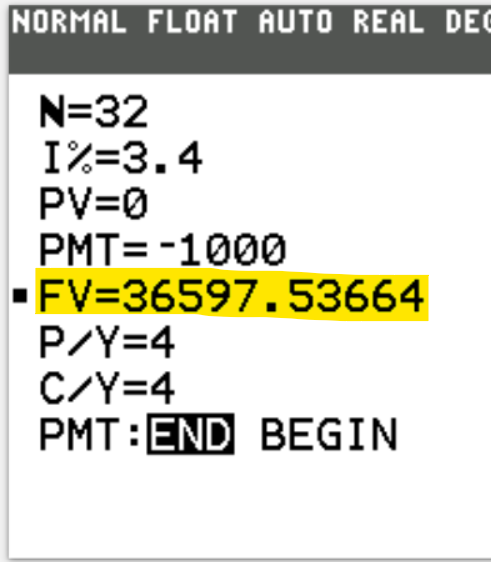

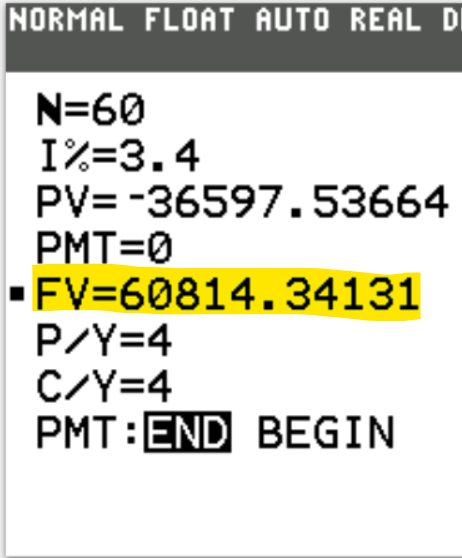

Future Value of Ordinary Annuity

$ (1.)\:\: FV = m * PMT * \left[\dfrac{\left(1 + \dfrac{r}{m}\right)^{mt} - 1}{r}\right] \\[10ex] (2.)\;\; FV = PMT * \dfrac{\left[\left(1 + \dfrac{r}{m}\right)^{mt} - 1\right]}{\dfrac{r}{m}} \\[10ex] (3.)\:\: t = \dfrac{\log\left[\dfrac{r * FV}{m * PMT} + 1\right]}{m * \log\left(1 + \dfrac{r}{m}\right)} \\[10ex] (4.)\:\: Total\:\:PMTs = PMT * m * t \\[3ex] (5.)\:\: CI = FV - Total\:\:PMTs \\[5ex] (6.)\:\: FV = PMT * \left[\dfrac{(1 + i)^n - 1}{i}\right] \\[7ex] (7.)\:\: n = \dfrac{\log\left[\dfrac{i * FV}{PMT} + 1\right]}{\log(1 + i)} \\[10ex] (8.)\:\: s_{n\i} = \dfrac{m}{r} * \left[\left(1 + \dfrac{r}{m}\right)^{mt} - 1\right] \\[7ex] (9.)\:\: s_{n\i} = \dfrac{(1 + i)^n - 1}{i} \\[5ex] (10.)\:\: FV = PMT * s_{n\i} \\[3ex] (11.)\:\: i = \dfrac{r}{m} \\[5ex] (12.)\:\: n = mt \\[3ex] (13.)\:\: Annual\:\:Fuel\:\:Expense = \dfrac{Annual\:\:Miles\:\:Driven}{Miles\:\:per\:\:Gallon} * Price\:\:per\:\:Gallon $

Sinking Fund

$ (1.)\:\: PMT = \dfrac{r * FV}{m * \left[\left(1 + \dfrac{r}{m}\right)^{mt} - 1\right]} \\[10ex] (2.)\:\: t = \dfrac{\log\left[\dfrac{r * FV}{m * PMT} + 1\right]}{m * \log\left(1 + \dfrac{r}{m}\right)} \\[10ex] (3.)\:\: Total\:\:PMTs = PMT * m * t \\[3ex] (4.)\:\: CI = FV - Total\:\:PMTs \\[3ex] (5.)\:\: PMT = \dfrac{i * FV}{(1 + i)^n - 1} \\[7ex] (6.)\:\: n = \dfrac{\log\left[\dfrac{i * FV + PMT}{PMT}\right]}{\log(1 + i)} \\[10ex] (7.)\:\: s_{n\i} = \dfrac{m}{r} * \left[\left(1 + \dfrac{r}{m}\right)^{mt} - 1\right] \\[7ex] (8.)\:\: s_{n\i} = \dfrac{(1 + i)^n - 1}{i} \\[5ex] (9.)\:\: i = \dfrac{r}{m} \\[5ex] (10.)\:\: n = mt $

Present Value of Ordinary Annuity

$ (1.)\:\: PV = m * PMT * \left[\dfrac{1 - \left(1 + \dfrac{r}{m}\right)^{-mt}}{r}\right] \\[10ex] (2.)\:\: t = -\dfrac{\log\left[1 - \dfrac{r * PV}{m * PMT}\right]}{m * \log\left(1 + \dfrac{r}{m}\right)} \\[10ex] (3.)\:\: PV = PMT * \left[\dfrac{1 - (1 + i)^{-n}}{i}\right] \\[7ex] (4.)\:\: n = \dfrac{\log \left[\dfrac{PMT}{PMT - i * PV}\right]}{\log(1 + i)} \\[10ex] (5.)\:\: a_{n\i} = \dfrac{m}{r} * \left[1 - \left(1 + \dfrac{r}{m}\right)^{-mt}\right] \\[7ex] (6.)\:\: a_{n\i} = \dfrac{1 - (1 + i)^{-n}}{i} \\[5ex] (7.)\:\: PV = PMT * a_{n\i} \\[3ex] (8.)\:\: i = \dfrac{r}{m} \\[5ex] (9.)\:\: n = mt \\[3ex] (10.)\:\: Total\:\:PMTs = PMT * m * t \\[3ex] (11.)\:\: CI = Total\:\:PMTs - PV $

Amortization

$ (1.)\:\: PMT = \dfrac{PV}{m} * \left[\dfrac{r}{1 - \left(1 + \dfrac{r}{m}\right)^{-mt}}\right] \\[10ex] (2.)\:\: t = -\dfrac{\log\left[1 - \dfrac{r * PV}{m * PMT}\right]}{m * \log\left(1 + \dfrac{r}{m}\right)} \\[10ex] (3.)\:\: PMT = \dfrac{i * PV}{1 - (1 + i)^{-n}} \\[7ex] (4.)\:\: n = \dfrac{\log \left[\dfrac{PMT}{PMT - i * PV}\right]}{\log(1 + i)} \\[10ex] (5.)\:\: i = \dfrac{r}{m} \\[5ex] (6.)\:\: n = mt \\[3ex] (7.)\:\: Payoff = PMT * n * \left[\dfrac{1 - \left(1 + \dfrac{r}{n}\right)^{-k}}{r}\right] \\[10ex] (8.)\:\: Total\:\:PMTs = PMT * m * t \\[3ex] (9.)\:\: CI = Total\:\:PMTs - PV \\[3ex] (10.)\:\: CI = PMT * m * t - PV \\[3ex] (11.)\:\: Number\:\:of\:\:payments = m * t \\[3ex] (12.)\:\: Down\:\:Payment = Given\:\:Rate * Purchase\:\:Price \\[3ex] (13.)\:\: Amount\:\:of\:\:Mortgage = Purchase\:\:Price - Down\:\:Payment \\[3ex] (14.)\:\: Payment\:\:for\:\:x\:\:points\:\:at\:closing = x\:\:as\:\:\% * Amount\:\:of\:\:Mortgage $

Future Value of an Annuity Due

$ (1.)\:\: FV = m * PMT * \left[\dfrac{\left(1 + \dfrac{r}{m}\right)^{mt} - 1}{r}\right] * \left(1 + \dfrac{r}{m}\right) \\[10ex] (2.)\:\: PMT = \dfrac{r * FV}{(m + r) * \left[\left(1 + \dfrac{r}{m}\right)^{mt} - 1\right]} \\[10ex] (3.)\:\: t = \dfrac{\log\left[\dfrac{r * FV}{PMT(m + r)} + 1\right]}{m * \log\left(1 + \dfrac{r}{m}\right)} \\[10ex] (4.)\:\: Total\:\:PMTs = PMT * m * t \\[3ex] (5.)\:\: CI = FV - Total\:\:PMTs \\[3ex] (6.)\:\: FV = PMT * \left[\dfrac{(1 + i)^n - 1}{i}\right] * (1 + i) \\[7ex] (7.)\:\: PMT = \dfrac{i * FV}{(1 + i)\left[(1 + i)^n - 1\right]} \\[7ex] (8.)\:\: n = \dfrac{\log\left[\dfrac{i * FV}{PMT(1 + i)} + 1\right]}{\log(1 + i)} \\[10ex] (9.)\:\: i = \dfrac{r}{m} \\[5ex] (10.)\:\: n = mt \\[3ex] (11.)\:\: CFV = P\left(1 + \dfrac{r}{m}\right)^{mt} + m * PMT * \left[\dfrac{\left(1 + \dfrac{r}{m}\right)^{mt} - 1}{r}\right] * \left(1 + \dfrac{r}{m}\right) \\[10ex] (12.)\:\: t = \dfrac{\log\left[\dfrac{rCFV + PMT(m + r)}{rP + PMT(m + r)}\right]}{m\log\left(1 + \dfrac{r}{m}\right)} $

Rule of 78

$ \underline{Monthly} \\[3ex] (1.)\:\: UI = \dfrac{TI * k * (k + 1)}{n(n + 1)} \\[5ex] (2.)\:\: TP = n * PMT \\[3ex] (3.)\:\: TI = TP - LA \\[3ex] (4.)\:\: RF = \dfrac{UI}{TI} \\[5ex] (5.)\:\: RF = \dfrac{sum\:\:of\:\:digits\:\:for\:\:up\:\:to\:\:k}{sum\:\:of\:\:digits\:\:for\:\:up\:\:to\:\:n} \\[5ex] (6.)\:\: LAR = LA * RF \\[3ex] (7.)\:\: UI = TI * RF $

Zero-Coupon Bonds

$ (1.)\:\: CP = \dfrac{CR * FV}{m} \\[7ex] (2.)\:\: YTM = \left(\dfrac{FV}{BP}\right)^{\dfrac{1}{t}} - 1 \\[7ex] (3.)\:\: BP = \dfrac{FV}{(YTM + 1)^t} \\[7ex] (4.)\:\: FV = BP * (YTM + 1)^t \\[5ex] (5.)\:\: t = \dfrac{\log\left(\dfrac{FV}{BP}\right)}{\log(YTM + 1)} $

Coupon Bonds

$ (1.)\:\: CP = \dfrac{CR * FV}{m} \\[5ex] (2.)\:\: BP = \dfrac{FV * CR}{YTM} * \left[1 - \dfrac{1}{\left(1 + \dfrac{YTM}{m}\right)^{mt}}\right] + \dfrac{FV}{\left(1 + \dfrac{YTM}{m}\right)^{mt}} \\[10ex] (3.)\:\: YTM \approx \dfrac{m * t * CP + FV - BP}{t(FV + BP)} \\[7ex] (4.)\:\: Annualized\:\:YTM \approx \dfrac{2(m * t * CP + FV - BP)}{t(FV + BP)} \\[7ex] (5.)\:\: YTM \approx \dfrac{t * CR * FV + FV - BP}{t(FV + BP)} \\[7ex] (6.)\:\: Annualized\:\:YTM \approx \dfrac{2(t * CR * FV + FV - BP)}{t(FV + BP)} \\[7ex] $